True or False?

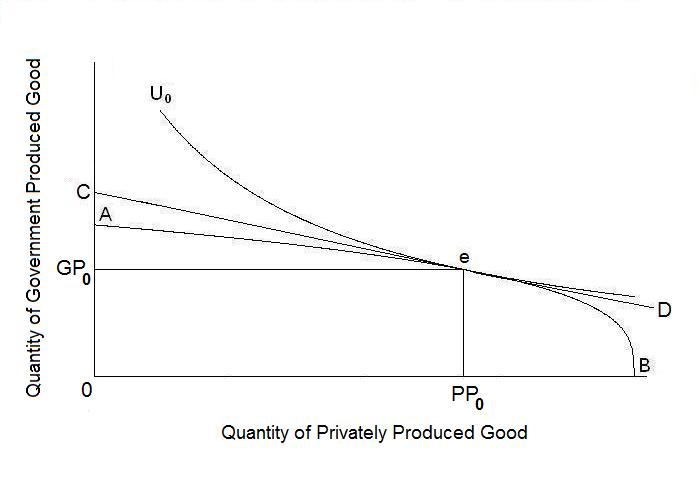

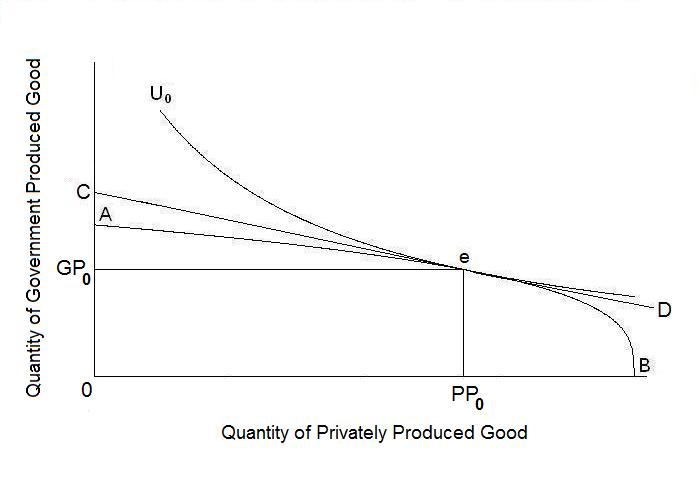

The statement is false. Consider the Figure below.

To do a perfect job in producing its good and making it available to the community, the government would have to produce the quantity GP0. This would leave sufficient resources available for the private sector to produce quantity PP0. At the equilibrium point e, the ratio of the marginal cost of the private good to that of the government good would be the slope of the production possibility curve and the ratio of the marginal utility of the private good to the marginal utility of the government good would be the slope of the indifference curve. Since there is only one good that has a price, we can normalize the price of that good, the private good, as unity. While the actual price of the government good is zero, that good will nevertheless have an implicit price equal to the ratio of the marginal utility of the government good over the marginal utility of the private good. The fact that the government good is available free of charge does not mean that consumers will consume it up to the point where its marginal utility is also zero. Indeed, the government decides how much consumers will consume when it decides how much of the good to produce.

The political nightmare involved in a real-world situation of many government and private goods is the process of deciding how much of each government good to produce since, while it is technically possible to the calculate the costs of producing government goods, indifference curves are unobservable.